Opening and Context

Between 2021 and 2023, the world experienced one of the most intense inflationary episodes in recent decades. Countries that once enjoyed price stability saw inflation soar — in the US, for example, the annual rate reached 9% in 2022, the highest in 40 years.

This inflationary surge was fueled in part by expansionary monetary and fiscal policies: to face crises like the pandemic, governments and central banks injected trillions of dollars into the economy through stimulus packages and quantitative easing, leading to a general increase in the monetary base.

In this scenario of fiat currency devaluation, the appeal of wealth-preserving assets grows. Bitcoin emerges as a unique candidate: it is the only digital asset with an absolutely limited supply (there will never be more than 21 million units) and independent from government policies. Unlike state money, it is impossible to “print” more Bitcoins to dilute its value.

"This programmed scarcity, combined with the decentralized nature of the network, makes Bitcoin a type of 'digital gold' immune to arbitrary inflation and political interference. Its network operates globally, 24 hours a day, without depending on traditional financial intermediaries or trust in governments."

Faced with this innovation, Solidus Wealth positions itself as a specialized partner for wealth investors seeking to navigate the Bitcoin universe with security and strategy. Founded in 2025, Solidus combines advanced technical knowledge of Bitcoin with institutional-level wealth management practices.

The consultancy offers complete custody solutions — such as geographically distributed multisig wallets — and tailored succession planning, ensuring that major investors adopt Bitcoin in a safe, private, and long-term family- or business-aligned manner.

Gold History and Evolution of Value Standards

For centuries, gold prevailed as the main store of value in the global economy. Several characteristics explain this historical role: gold is extremely durable, capable of lasting generations without losing physical properties; it is fungible, meaning each gram of pure gold is equivalent to any other gram, facilitating exchanges; and it has universal acceptance — practically all cultures have recognized its intrinsic value throughout history.

Thanks to its relative scarcity and extraction difficulty, gold served as a monetary anchor at various points, bringing stability to national currencies. Unsurprisingly, for centuries countries adopted gold-backed monetary standards to control inflation and promote confidence in money.

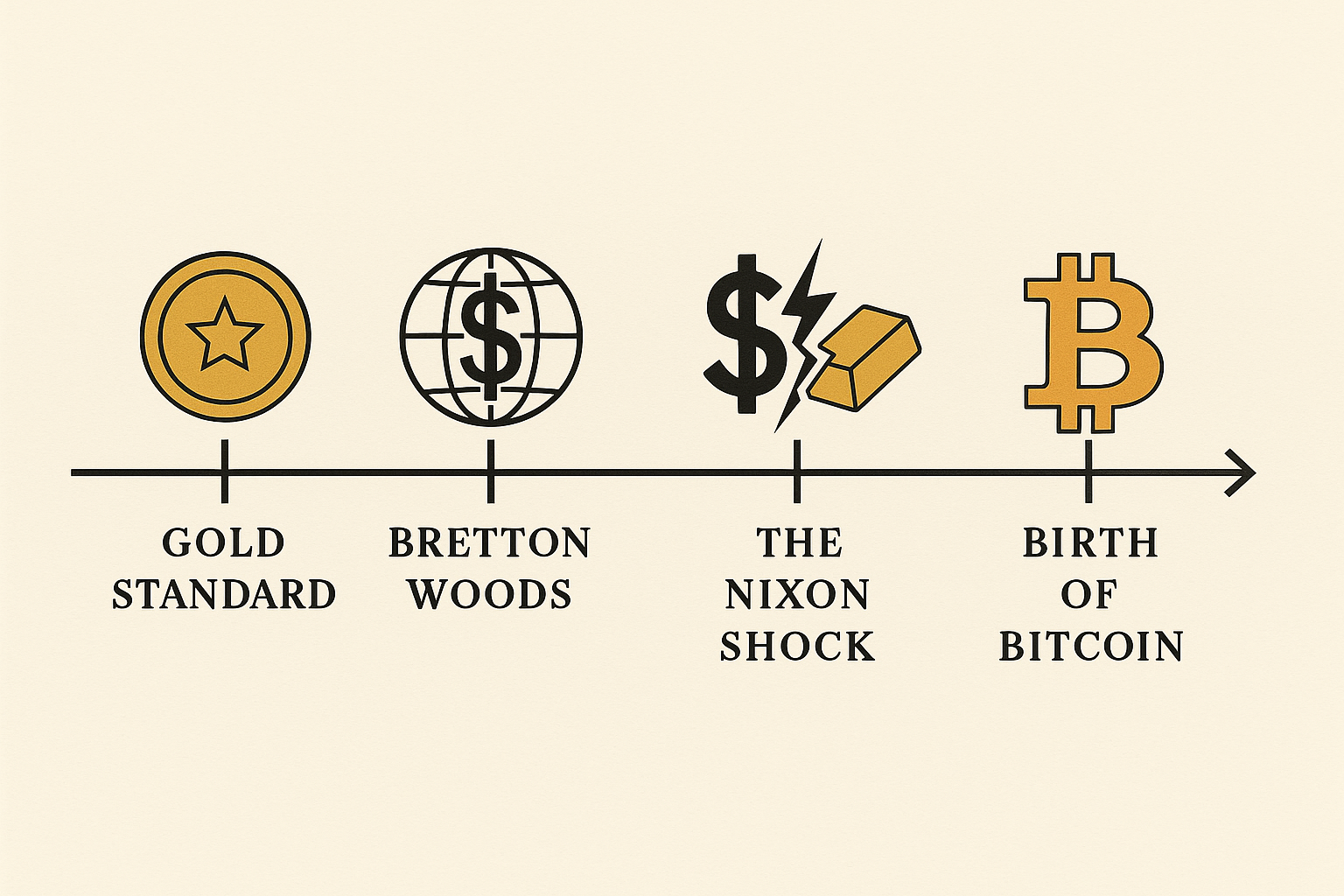

Timeline: Monetary Standards

19th Century

Widespread adoption of the gold standard, where national currencies were directly convertible into physical gold.

1944 - Bretton Woods

Establishment of the Bretton Woods system, where the US dollar was backed by gold and other currencies were pegged to the dollar.

1971 - Nixon Shock

The US unilaterally suspended the convertibility of the dollar into gold, marking the end of the gold standard and the beginning of the fiat system.

2009 - Bitcoin

Bitcoin launched, creating a new paradigm of digital scarcity and independence from central governments.

However, maintaining a gold standard posed growing challenges in the 20th century. World wars and expansionary fiscal policies imposed heavy costs on governments, which began printing money beyond available gold reserves. In 1971, the United States — which since Bretton Woods guaranteed the dollar’s convertibility into gold — unilaterally suspended the dollar’s gold backing, definitively ending the gold standard era.

This move (known as the Nixon Shock) was driven by the inability to honor conversion amid exorbitant spending, particularly with the Vietnam War. From then on, the world’s major currencies adopted a fiat standard, without backing in precious metals, floating according to supply and demand.

With fiat currencies subject to inflation and loss of purchasing power over time, traditional investors sought alternatives for wealth preservation. In recent decades, real assets and equity stakes have stood out as alternative stores of value to money:

Real Estate

“Appreciated” in value and generate “income,” considered safe havens in times of monetary uncertainty.

Collectibles

Artworks, rare wines, and jewelry serve as tangible wealth deposits.

Commodities

Heavy equipment and commodities (tractors, machinery, stored barrels of oil) work as protection against weak currencies.

Stocks

Shares of companies or family business quotas became wealth concentrators for many families, as they represent ownership of productive assets tied to the real economy.

"In short, in the absence of a stable standard like gold, high-net-worth individuals diversified into non-monetary assets to escape fiat money erosion."

Bitcoin Superiority Over Gold

Bitcoin is often nicknamed "digital gold," but its properties go further, offering practical advantages over physical gold in several fundamental aspects:

Absolute Scarcity

While gold has an ever-increasing supply (mining adds several tons per year to the global stock), Bitcoin was designed with a fixed maximum supply of 21 million units. This mathematical scarcity is immutable and grants the asset superior resistance to inflation — no authority can create additional Bitcoins by decree.

Global Portability

Gold, being physical and heavy, is difficult to transport and manage logistically (international gold shipments are slow, expensive, and risky). Bitcoin, on the other hand, can be transferred worldwide in just minutes over the internet, regardless of the amount being moved.

Verifiability

Assessing the purity and authenticity of gold requires expertise, chemical testing, or certifications — a costly process vulnerable to fraud. With Bitcoin, every unit and transaction is publicly verifiable on the distributed ledger (blockchain).

Divisibility

Gold can be divided into coins or smaller bars, but there is a practical limit. Bitcoin is highly divisible, down to 100 million smaller units (satoshis) without losing unit value.

Bitcoin vs Gold Comparison

| Characteristic | Gold | Bitcoin |

|---|---|---|

| Scarcity | Relative (new supply via mining) | Absolute (21 million fixed) |

| Portability | Difficult and costly (physical weight) | Instant and global |

| Verifiability | Requires specialized testing | Public and transparent |

| Divisibility | Limited (grams, ounces) | Up to 8 decimal places |

| Storage | Physical vaults, security costs | Digital, no physical costs |

| Censorship Resistance | Can be confiscated | Uncensorable |

In summary, Bitcoin incorporates and enhances gold’s key qualities as a store of value. It is just as scarce (or more), easier to store and transport, and brings auditable transparency to every unit in circulation. These advantages have led many to see Bitcoin as the modern replacement for gold in long-term wealth preservation — an asset aligned with the digital age, without the logistical drawbacks of precious metals.

Who Has Already Adopted It?

The adoption of Bitcoin as part of treasury and investment strategies is no longer limited to technology enthusiasts. Major companies, governments, and renowned investors are moving to include it in their balance sheets and portfolios:

Companies

- MicroStrategy (500,000+ BTC)

- Tesla (US$ 1.5 billion in BTC)

- Méliuz (1st Bitcoin Treasury Company in Brazil)

Governments

- El Salvador (legal tender)

- Hong Kong (approved ETFs)

- Brazil (tax exemption for mining machines)

Investors

- Paul Tudor Jones (2% of net worth)

- Ray Dalio (1% of portfolio)

- Larry Fink (CEO of BlackRock)

Méliuz: Brazilian Case

Méliuz, a cashback and financial services fintech, adopted Bitcoin as part of its strategic reserves, officially becoming the first Bitcoin Treasury Company in the country.

After being approved by shareholders in a May assembly, Méliuz used internal resources and proceeds from a follow-on share offering to ramp up its acquisitions.

This move elevated Méliuz to the position of the largest Bitcoin holder among publicly traded companies in Latin America, currently ranking between 36th–39th globally among companies with the largest BTC treasuries.

Méliuz Acquisitions

Strategic Benefits

By integrating Bitcoin into traditional portfolios, high-net-worth investors gain unique attributes of protection and flexibility that conventional assets cannot always provide:

Inflation Hedge

Its finite supply prevents dilution, and the cryptocurrency has gained credibility precisely for offering protection against monetary expansion driven by governments and central banks.

Censorship and Confiscation Resistance

Unlike traditional financial instruments, which can be frozen by governments or blocked by institutions, Bitcoin operates on a borderless, decentralized network.

Global Portability and Mobility

Bitcoin allows capital to be moved internationally with speed and low cost, especially useful for families with members or interests in different countries.

Renewable Energy and Mining

A common concern about Bitcoin relates to energy consumption in mining. However, what many traditional investors don’t realize is that the Bitcoin mining industry is becoming increasingly "green" and can, in fact, drive the development of clean energy.

In Northeastern Brazil, for example, companies are starting to take advantage of the abundance of sun and wind to power mining farms with solar and wind energy. Partnerships with renewable energy cooperatives and local producers enable the installation of mining data centers near solar or wind farms, converting surplus energy (which often goes to waste due to lack of constant demand) into economic value.

This reduces electricity costs for miners and generates extra revenue for clean energy producers, creating a virtuous cycle of investment in renewables.

"Globally, the trend is no different: it is estimated that 54.5% of the energy used in Bitcoin mining already comes from sustainable sources (solar, wind, hydro, biomass), a historic record that reflects the sector’s ongoing effort to improve its environmental footprint."

Sustainable Mining in Brazil

Studies indicate that there is plenty of idle energy in the grid (due to losses or excess capacity in certain regions/tariffs), and Bitcoin mining can help unlock this potential, monetizing surplus energy and funding the expansion of clean sources.

Traditional investors, in turn, can benefit by joining sustainable mining consortia or funds that support “energy-for-mining” projects.

Positive Impact

- Reduction of energy waste

- Funding for renewable expansion

- Generation of carbon credits

- Balancing of power grids

Wealth Succession with Bitcoin

A crucial aspect for high-net-worth investors is succession planning — ensuring that wealth is passed efficiently and securely to the next generation. In this regard, Bitcoin introduces remarkable advantages compared to traditional assets:

Fast and Direct Transfer

Unlike real estate or company shares, whose transfer to heirs depends on court or notary probate proceedings (a process that can take months or years), Bitcoin can be passed almost instantly to designated successors.

Greater Liquidity and Availability

Many traditional assets suffer from low liquidity in the context of inheritance — for example, real estate takes time to sell, and company shares depend on corporate agreements. Bitcoin, on the other hand, is a globally traded asset, 24/7.

Less Bureaucracy and Lower Costs

The transfer of Bitcoins can be structured to minimize bureaucratic steps. Compare with real estate inheritance: it requires probate, ITCMD tax payment, and registry updates — an expensive and time-consuming process.

Wealth Succession Comparison

| Asset Type | Succession Process | Average Time | Costs |

|---|---|---|---|

| Real Estate | Probate and partition; public deed; ITCMD payment (4–8%); registry update | 6–24 months | High (notary fees, taxes, legal fees) |

| Stocks and Shares | Death notification; account freeze; probate ruling; transfer to heirs’ accounts | 3–12 months | Moderate (fees, share valuation) |

| Bitcoin | Delivery of private keys or seeds to heirs as defined by arrangement | Immediate to a few days | Minimal (network fees, advisory fees) |

Practical Cases

To illustrate concretely how these concepts apply, here are three hypothetical scenarios of traditional investors using Bitcoin with the support of Solidus Wealth:

Simplified Family Succession

A family implemented a multisig custody solution with 3 keys: one with the patriarch, another with the matriarch, and the third under Solidus’ custody.

After the patriarch’s passing, the transfer of bitcoins to the heirs will be completed in just a few days, while other estate assets will still be tied up in probate months later.

Protection Against Currency Depreciation

An agribusiness entrepreneur decided to convert part of his reserves (around 10% of his wealth) into Bitcoin as protection.

When the Brazilian real depreciated by another 20% against the dollar, the Bitcoin position appreciated in reais by almost the same proportion, offsetting the loss of domestic purchasing power.

Philanthropic Foundation

A philanthropic couple manages a foundation that decided to allocate 3% of its endowment to Bitcoin.

If Bitcoin experiences strong appreciation in the coming decades, this small portion could multiply and fund many more scholarships in the future, acting as a high-impact investment.

ETF Trading Volumes

ETF Comparison

The Bitcoin ETF surpassed the gold ETF’s volume in under two years, while GLD took nearly two decades to reach similar levels.

A powerful indicator of Bitcoin’s consolidation within traditional investments is the success of Bitcoin ETFs in global markets. Compared with gold—the long-standing benchmark store of value—we see extremely rapid adoption of Bitcoin by equity investors:

BlackRock’s U.S. Bitcoin ETF (IBIT), launched in January 2024, quickly reached impressive volumes. In less than two years of operation, IBIT trades roughly 40 to 50 million shares per day on average. This comfortably exceeds the daily volume of the world’s largest gold ETF, SPDR Gold Shares (GLD), which moves approximately 9 to 10 million shares daily.

In historical perspective: GLD was launched in 2004 and took nearly two decades to reach daily trading volumes in the 8–10 million range. The Bitcoin ETF, by contrast, exceeded that level almost immediately after launch and has sustained elevated volumes.

“Analysts point out this was possibly the biggest ETF debut in history, reflecting years of pent-up demand. IBIT’s robust liquidity builds confidence and narrows spreads, further reinforcing institutional interest.”

Mitigating Risks

Every innovative investment raises questions and requires risk management, especially for those who have built significant wealth over decades. In Bitcoin’s case, the two most cited concerns are price volatility and custody security.

Volatility tempered by a long-term view

It’s true that Bitcoin shows much sharper short-term swings than traditional asset classes. Moves of +20% or −20% within a single month are not uncommon.

However, with a longer investment horizon, history shows a remarkably resilient upward trajectory. Despite several sharp drawdowns over the past 13 years, Bitcoin has subsequently recovered and reached new price highs on every occasion so far.

For traditional investors, this suggests that a small allocation to Bitcoin, held with discipline across full cycles, tends to dilute idiosyncratic volatility within the portfolio and can improve aggregate returns.

Custody security and professional support

Security in the Bitcoin world depends primarily on how private keys are stored. For non-technical investors, this can be daunting—news about hacks or lost passwords can create fears of irreversible loss.

That’s why professional custody solutions are essential. Solidus Wealth, for example, implements institutional-grade Bitcoin storage architectures: multisig (multi-signature) wallets with configurable quorum, distributing keys across distinct locations (including different continents) to eliminate single points of failure.

Another source of peace of mind is 24/7 monitoring and specialized support: unlike a solo investor who might panic if something goes wrong, those with advisory support have immediate help available in emergencies.

Security Best Practices with Solidus Wealth

Intercontinental Multisig

Keys distributed across different jurisdictions for maximum security.

Hardware Wallets

Dedicated physical devices for offline key storage.

24/7 Support

A technical team available to assist with any emergency or question.

Further Reading

For investors who want to dive deeper into the economic foundations and technological outlook behind Bitcoin, we recommend the following readings:

The Bitcoin Standard

Saifedean Ammous

An essential book that draws a historical parallel between the emergence of Bitcoin and the evolution of money, explaining why Bitcoin has the attributes to become a global store of value in the 21st century.

Learn more →

The Price of Tomorrow

Jeff Booth

A work discussing technology’s deflationary forces and the central-bank dilemma in a world of exponential advances. Booth argues that innovation inevitably lowers prices and that today’s system is on an unsustainable path.

Learn more →Conclusion

Bitcoin has long ceased to be a niche curiosity and has become a strategic component in the management of large fortunes. If you are a traditional investor seeking wealth protection, succession efficiency, and exposure to an emerging asset with high potential, it’s time to consider Bitcoin seriously and with proper information.

With the right knowledge and specialized advisory such as that from Solidus Wealth, risks can be mitigated and benefits maximized. Bitcoin offers a unique combination of characteristics that make it particularly well-suited for long-term wealth preservation:

- Programmed scarcity and resistance to inflation

- Global portability and 24/7 liquidity

- Unmatched transparency and verifiability

- Succession efficiency unparalleled in traditional assets

More than a simple investment alternative, Bitcoin represents a new way of thinking about property, financial sovereignty, and the transmission of wealth across generations. With the right approach and proper support, it can become a fundamental pillar in the wealth strategy of families and institutional investors.

Ready to protect your wealth with Bitcoin?

Schedule your confidential consultation with Solidus Wealth to explore in detail how Bitcoin can strengthen your portfolio. Our team will provide a free assessment of your portfolio and succession planning.

Schedule Consultation